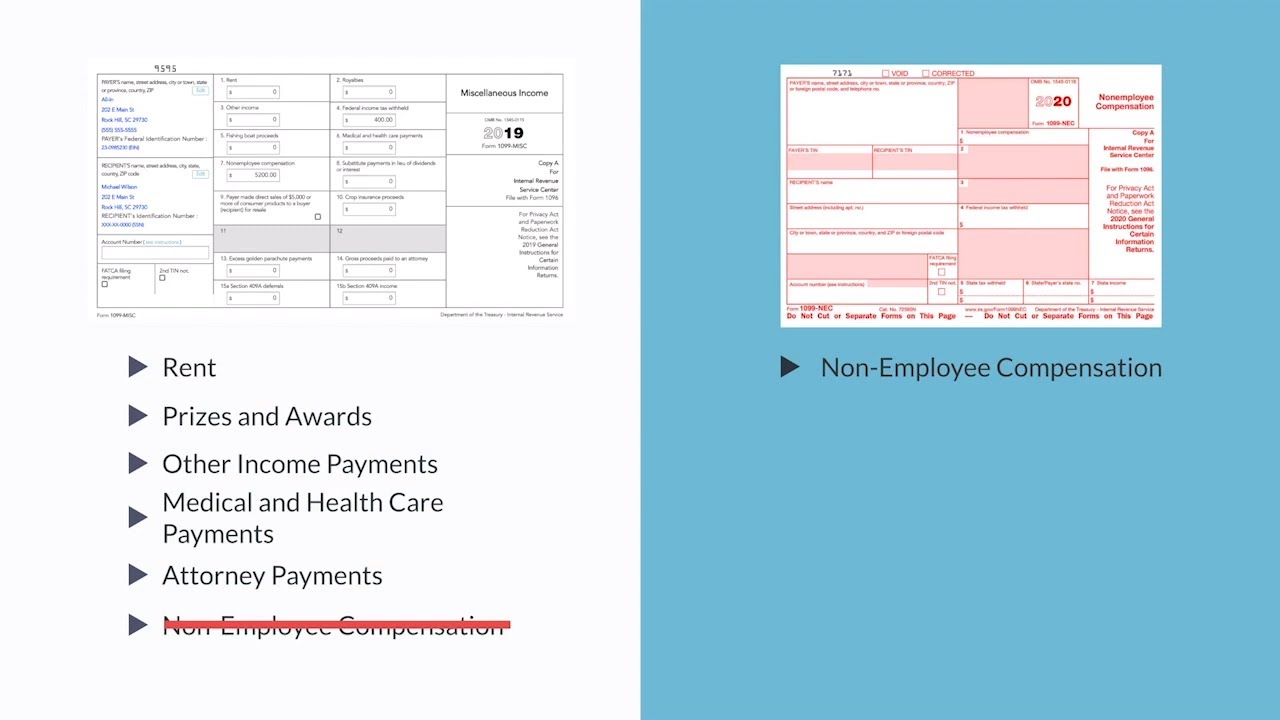

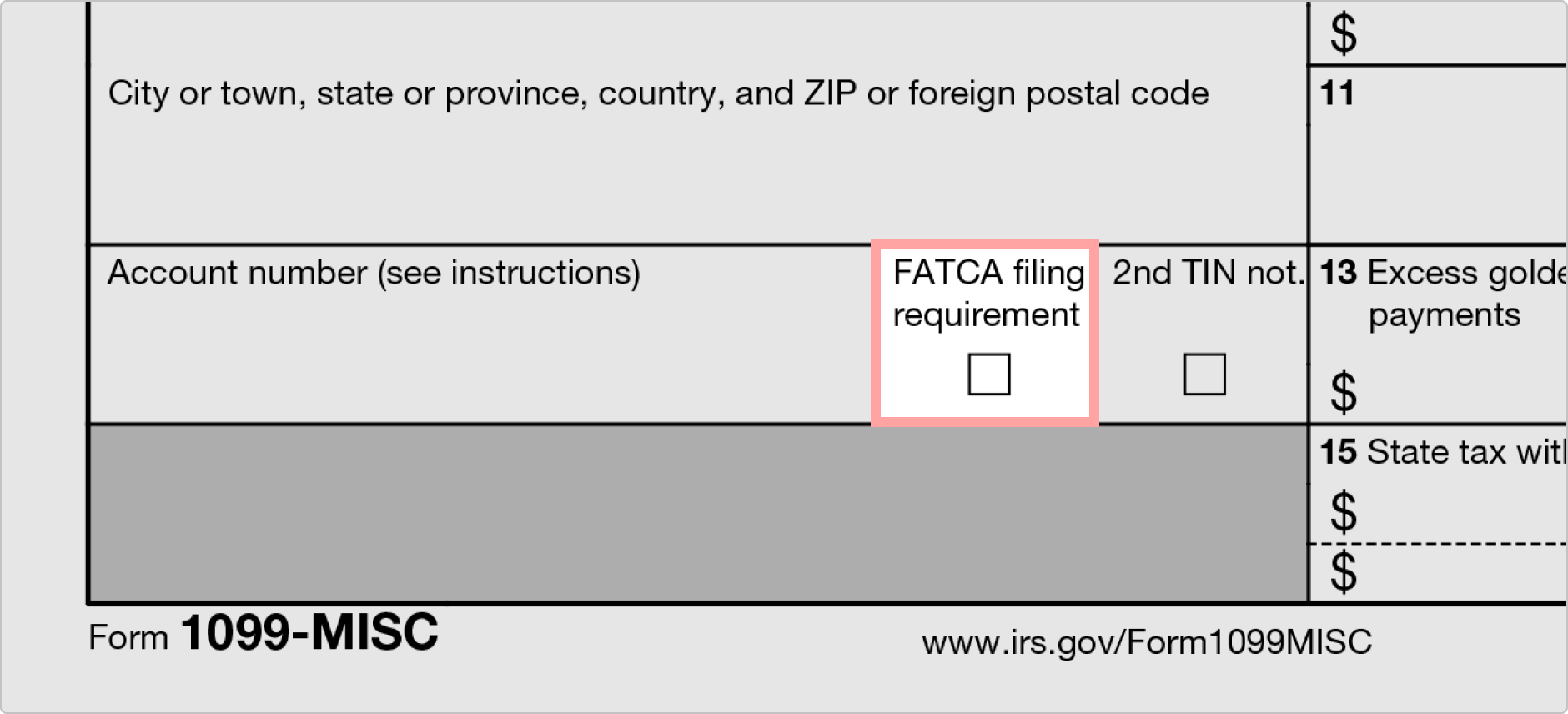

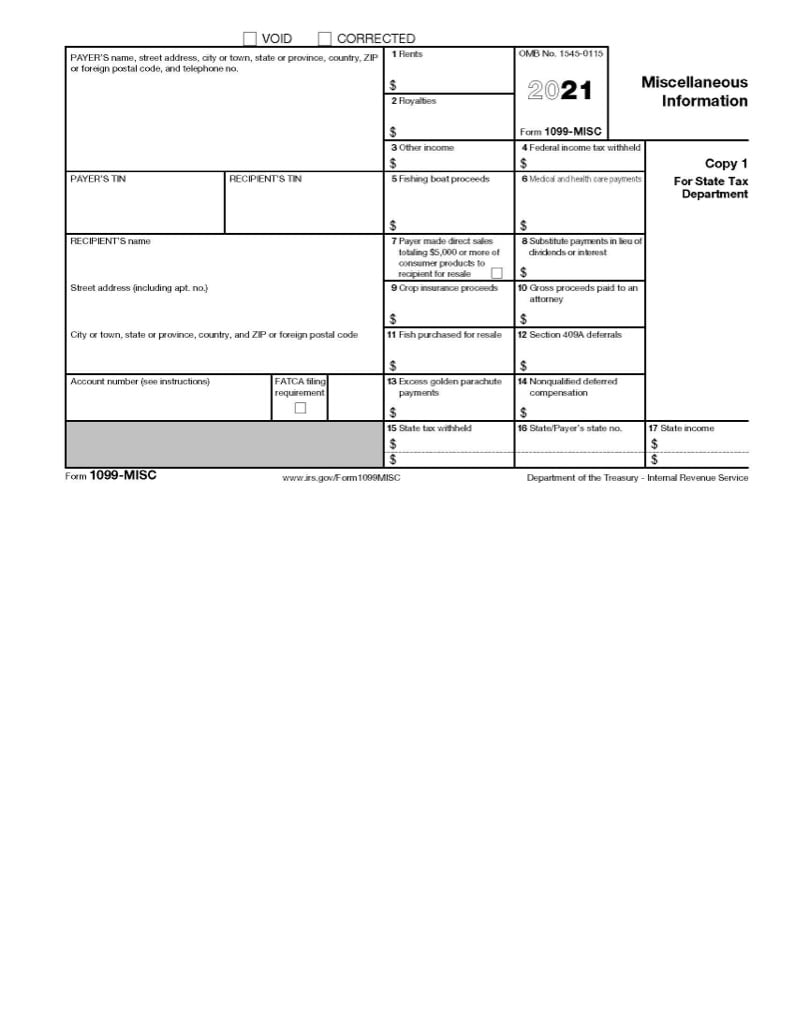

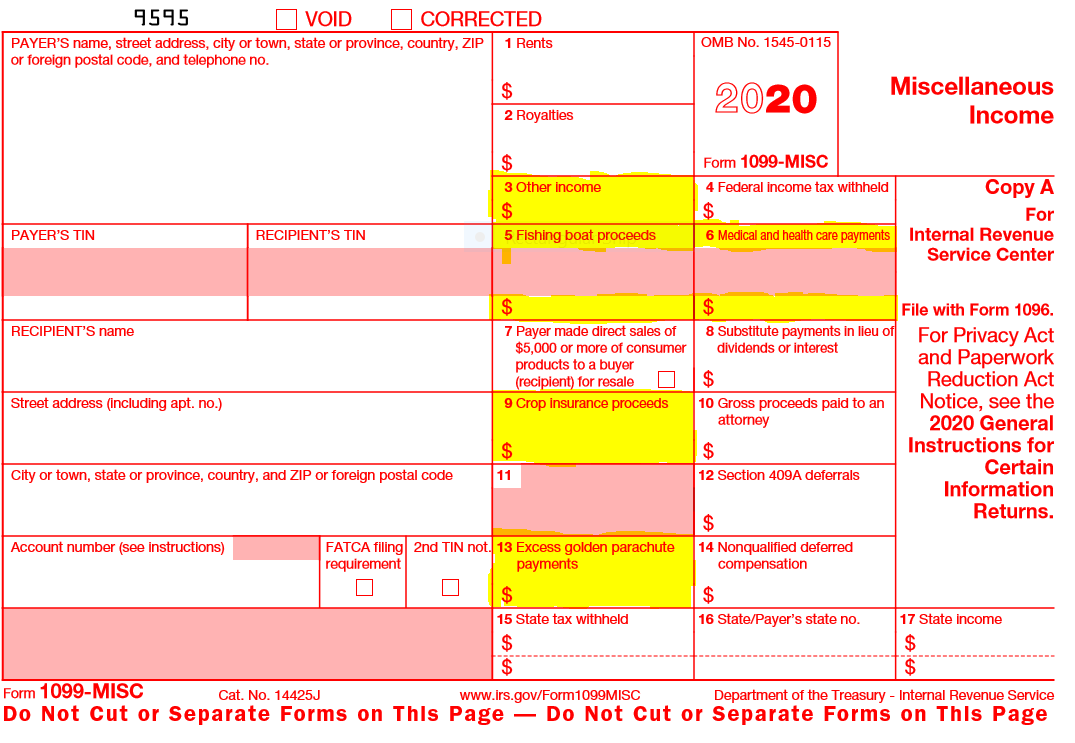

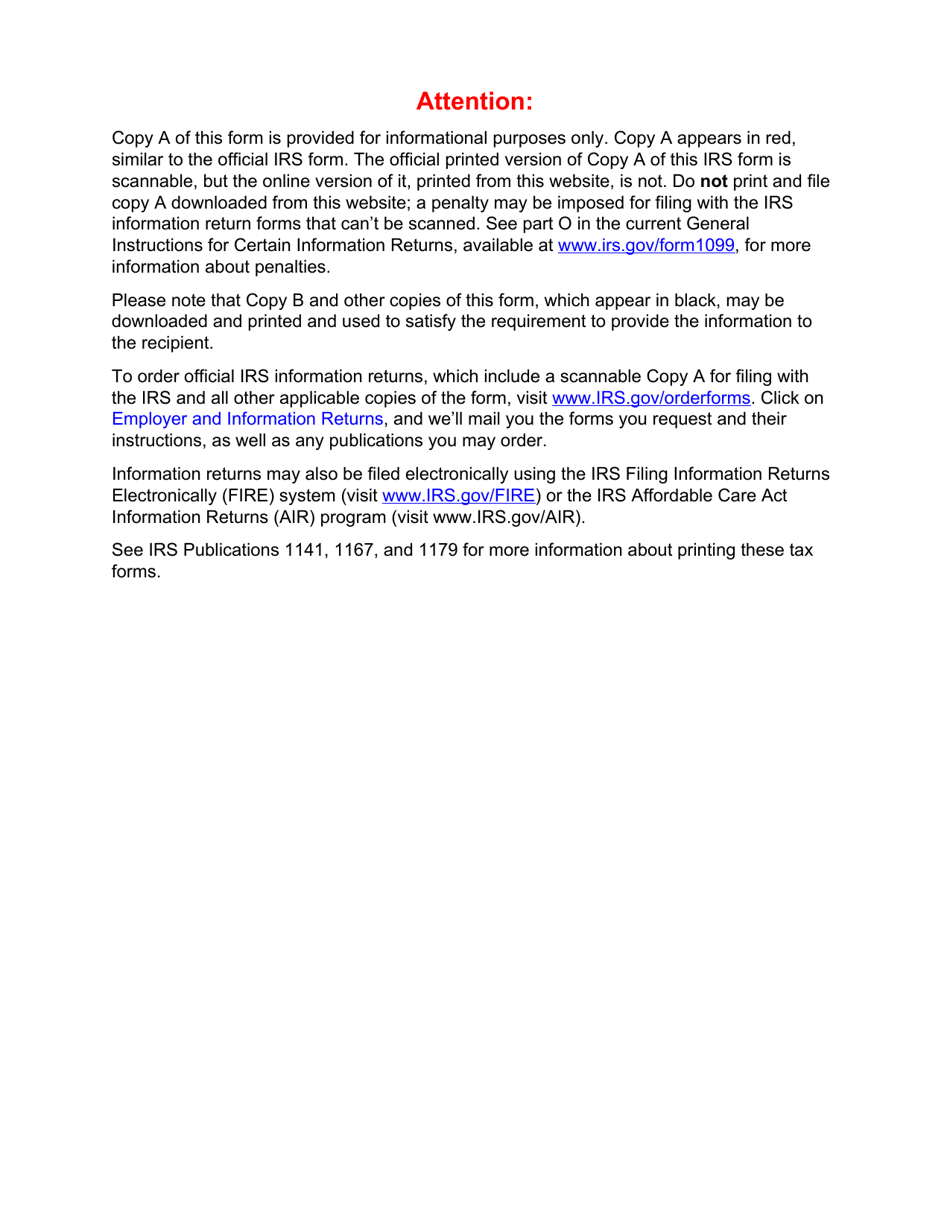

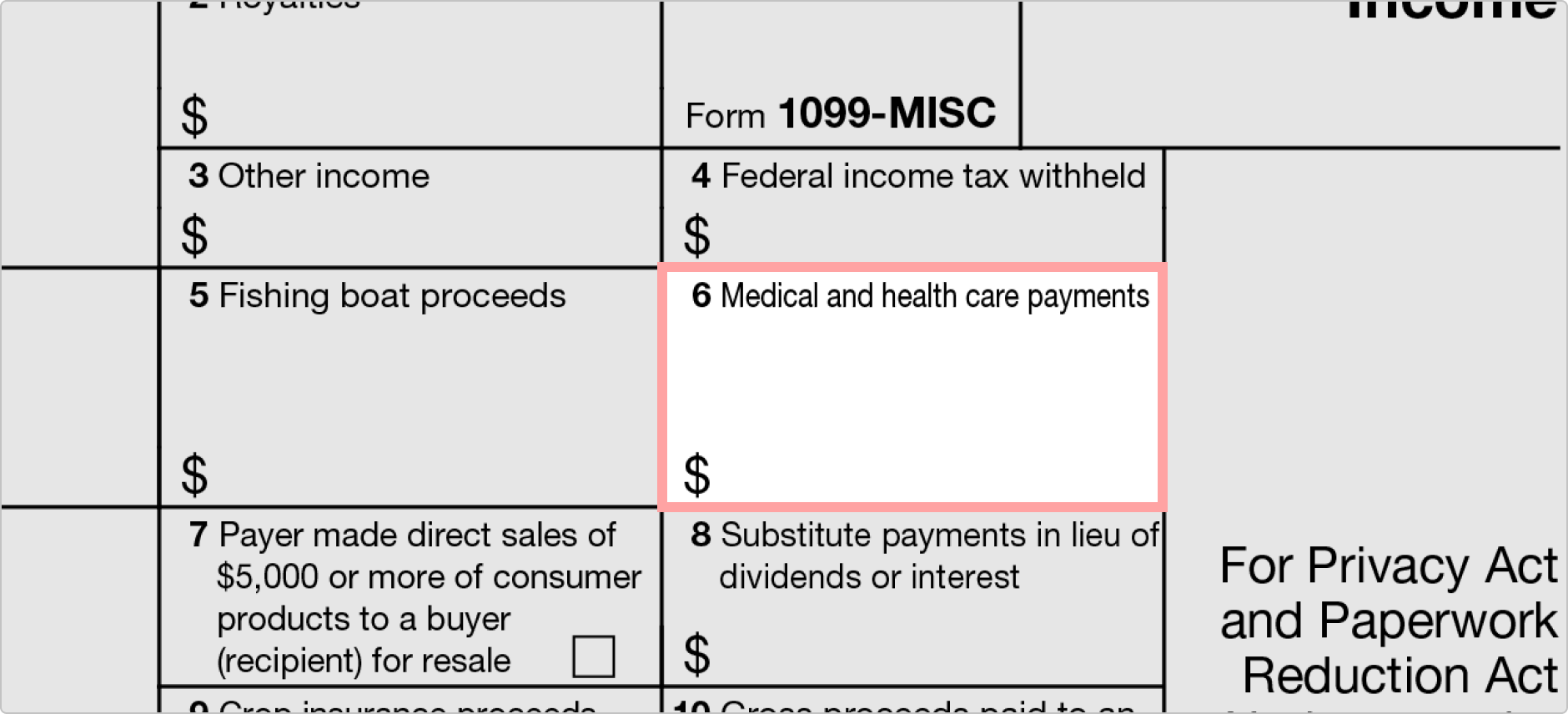

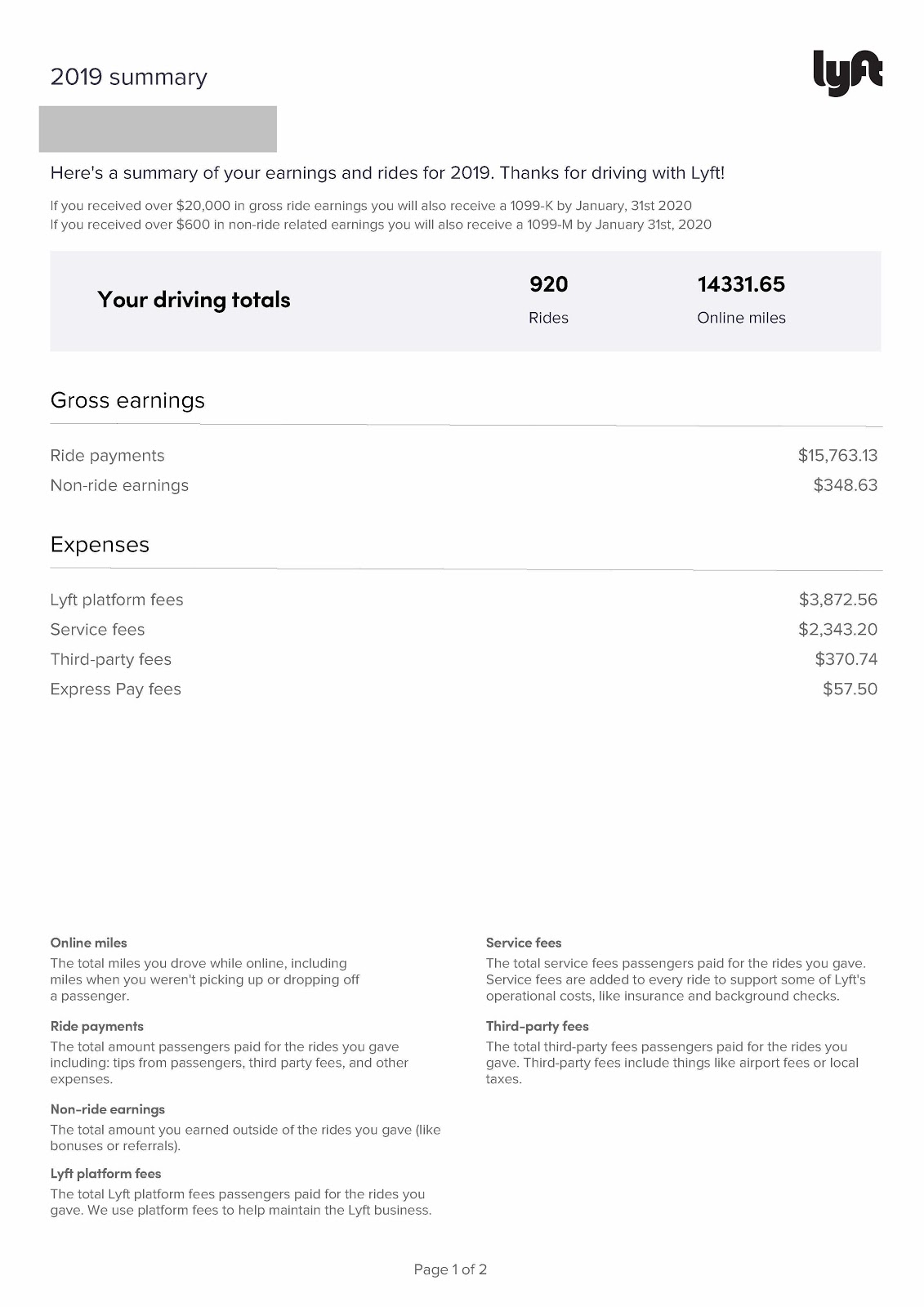

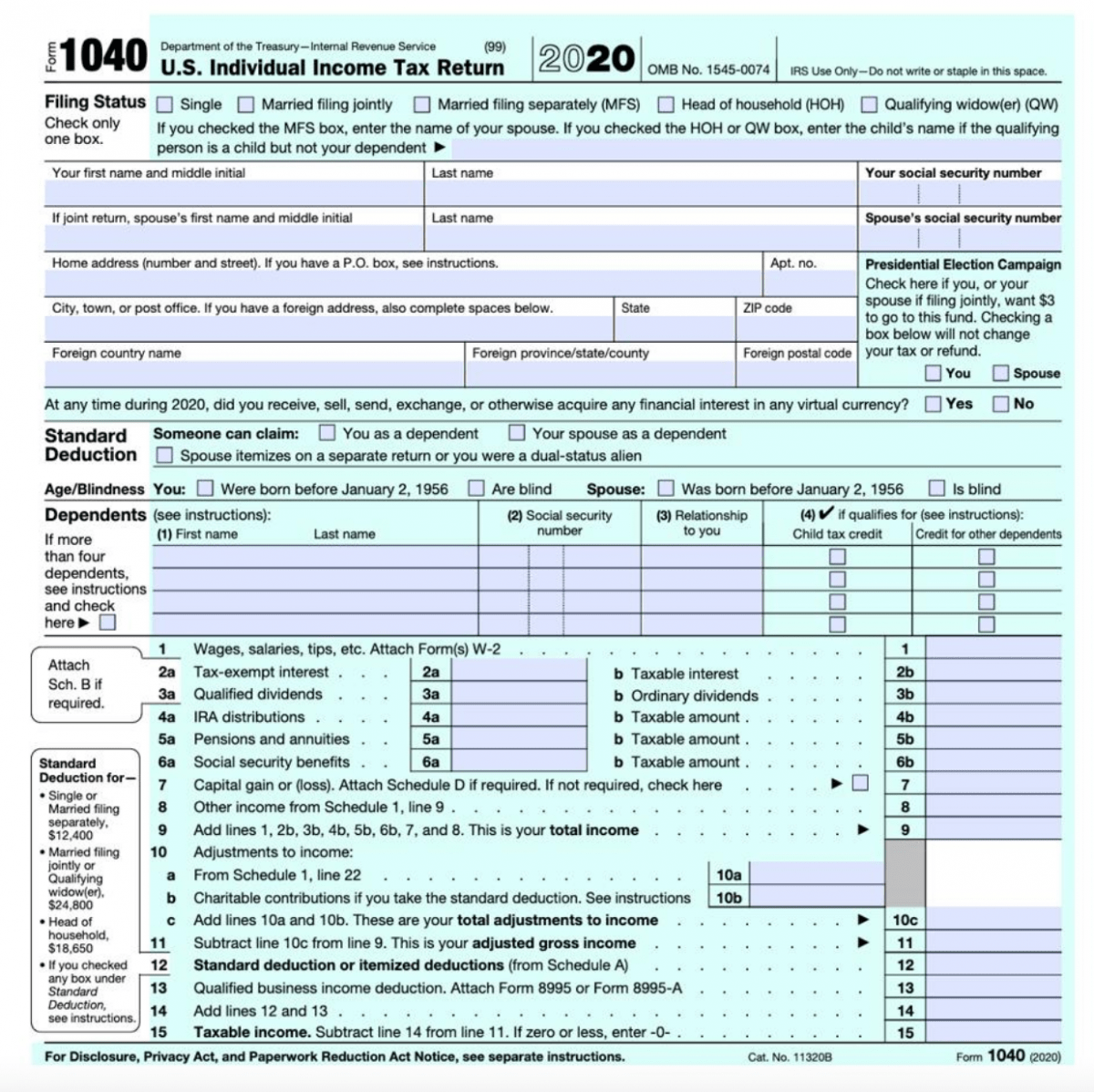

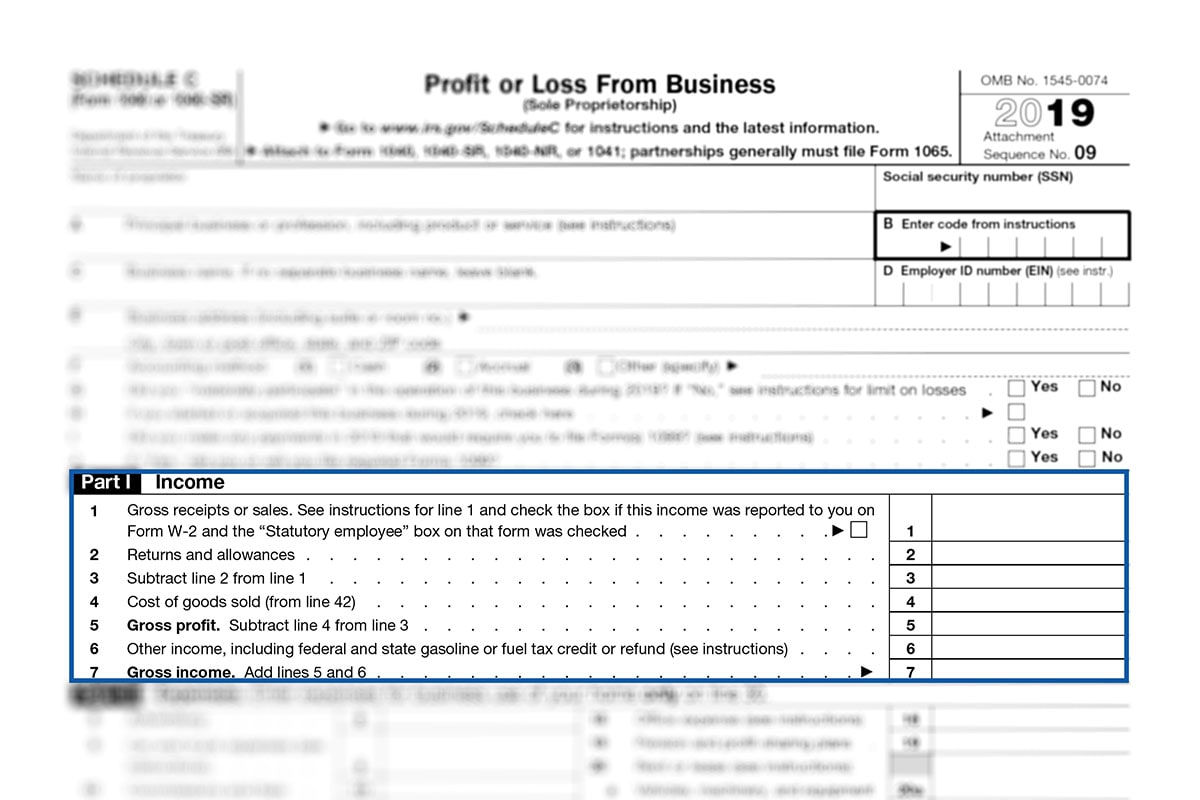

If you received a Form 1099MISC (prior to tax year ) with income reported in boxes 5, 6, or 7, or Form 1099NEC, box 1 (beginning with tax year ), you must report the income on a Schedule C To determine why you are required to file a Schedule C please click here If you were to just report the income as Other Income, the SocialYou reported the amount as gross income of a business on the federal Schedule C (Form 1040), Part I, line 7 Schedule CA (540NR), you will report the amount as wages on Part II, Section A, line 1, Column C You reported the amount as business income on federal Schedule 1 (Form 1040Schedule C is the form used to report income and expenses from selfemployment This can encompass owning a digital or brickandmortar small business, freelancing, contracting, and gig work such as rideshare driving If you receive a Form 1099MISC, 1099NEC, and/or 1099K, you are likely to have to report it on Schedule C along with other

1099 Nec Filing Due On Feb 1 21 Advisori Finance Cpas For Startups

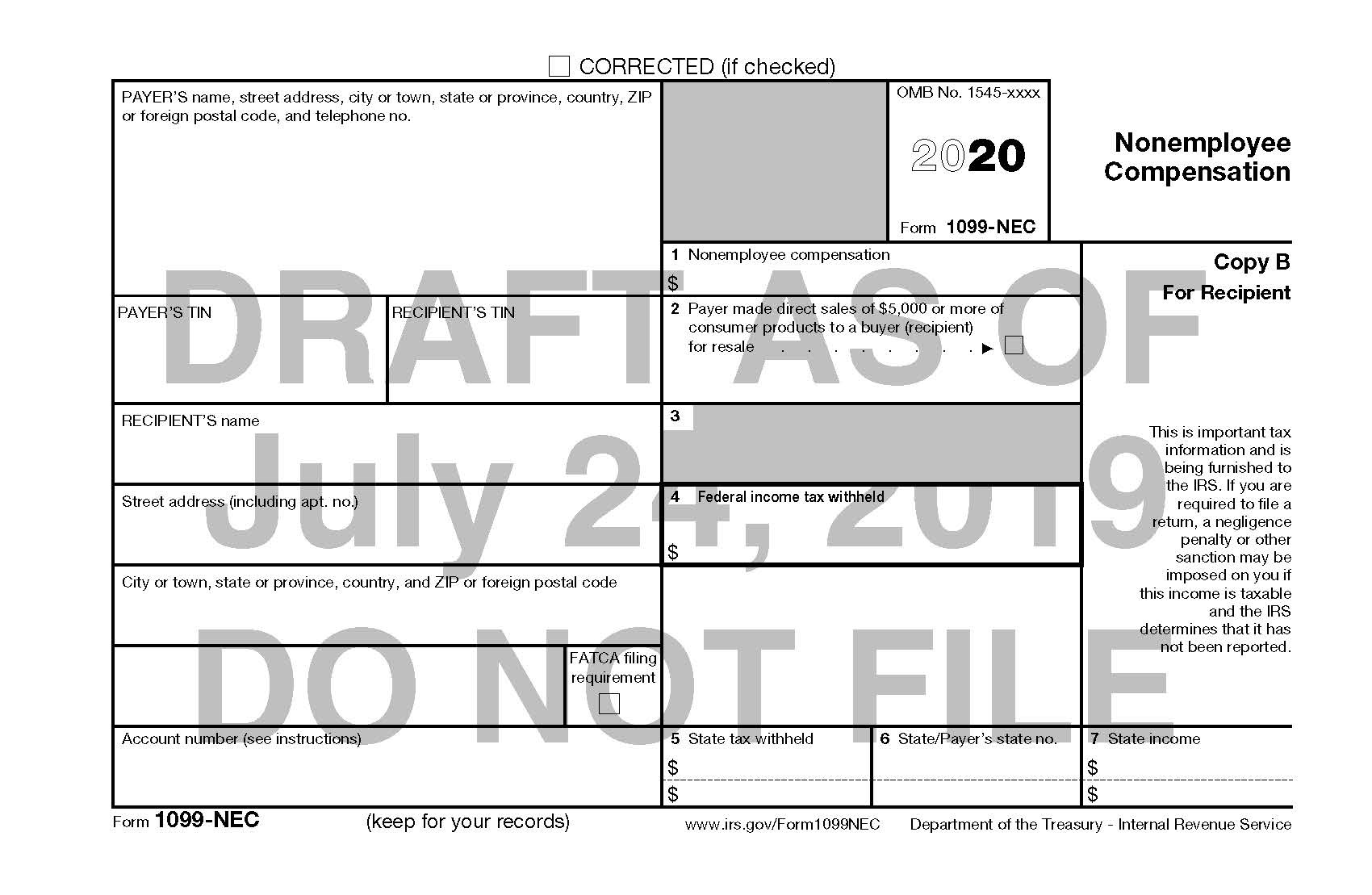

How to fill out 1099 nec

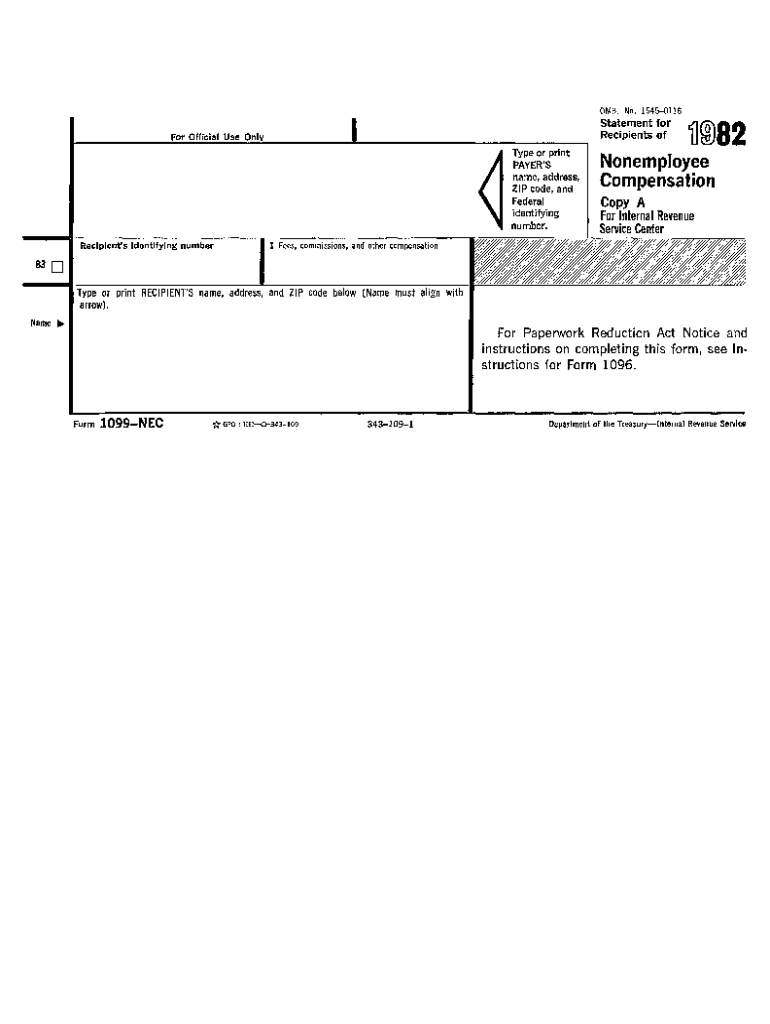

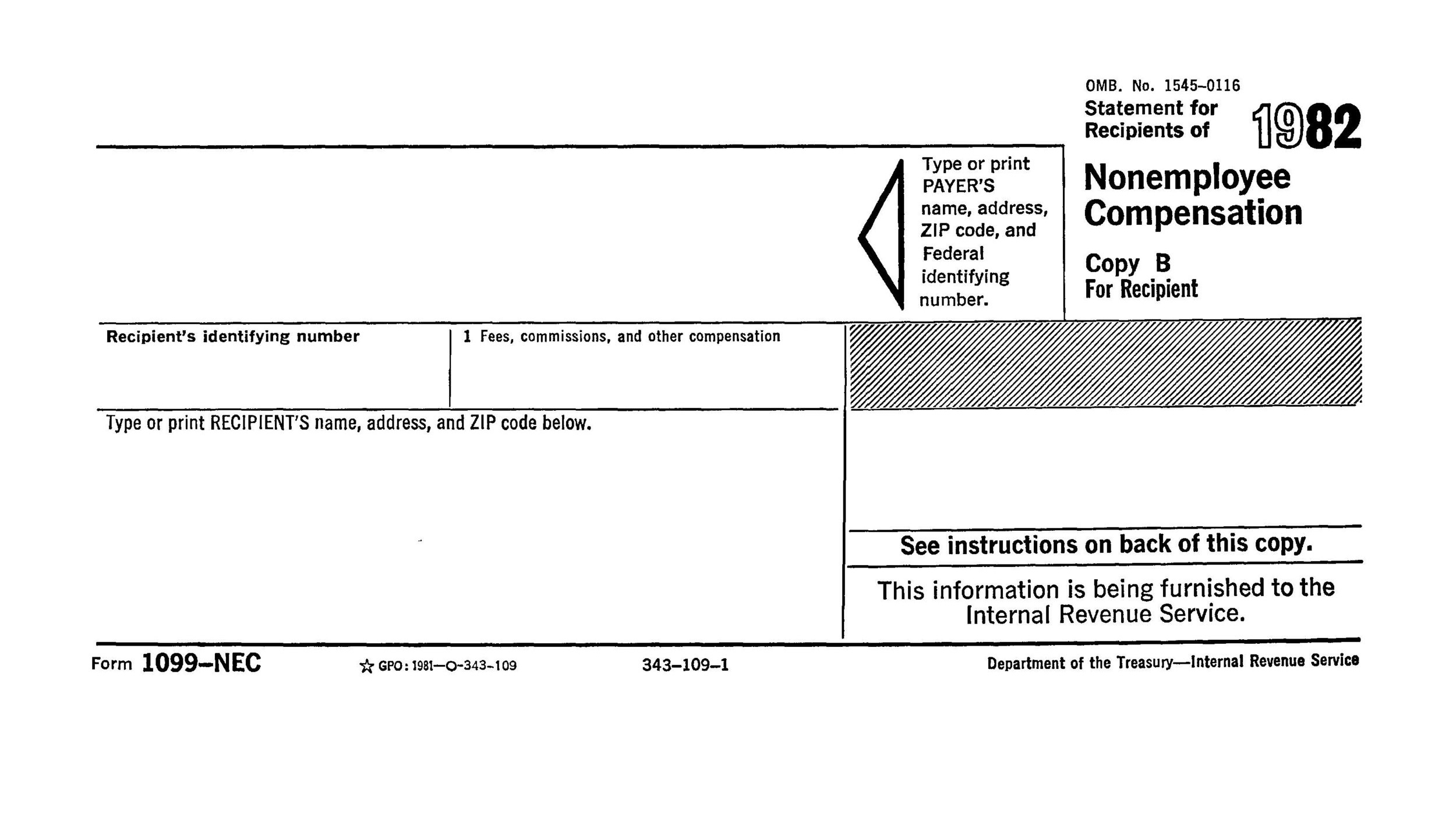

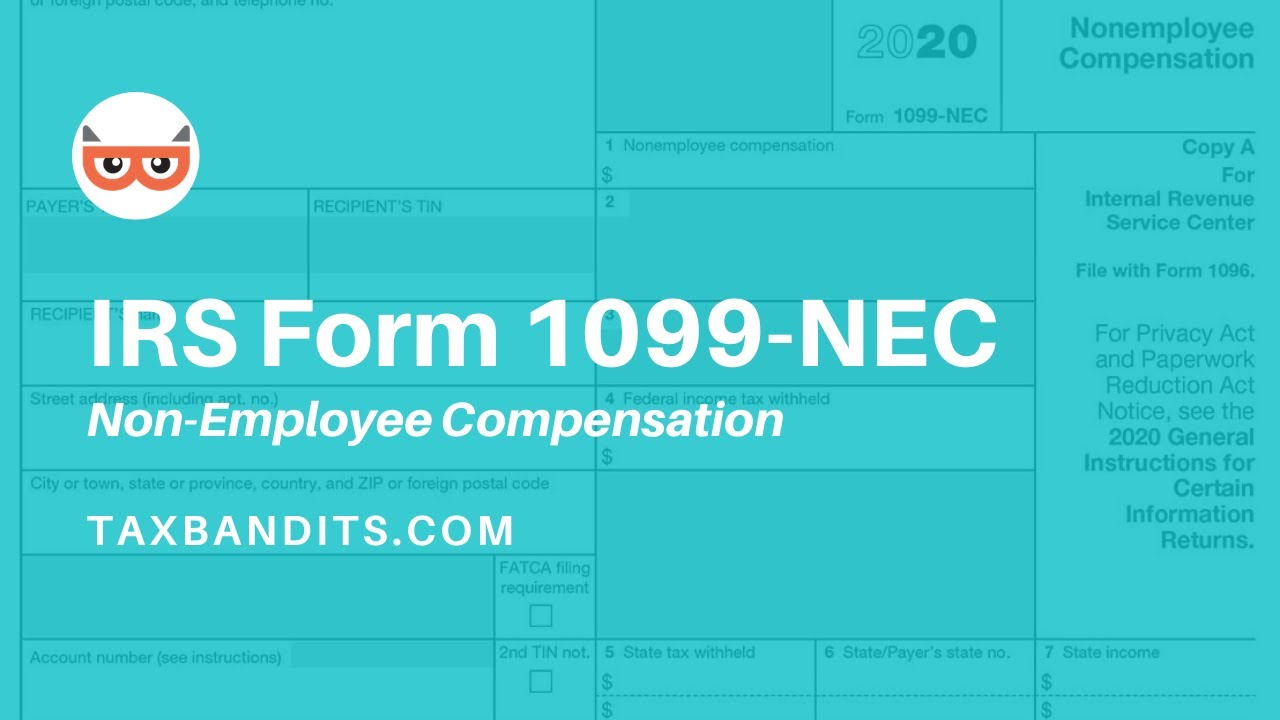

How to fill out 1099 nec-When you earn money by performing work, that income is usually subject to social security and Medicare taxesThe new Form 1099NEC—which is actually an old form that hasn't been in use since 19—is used to report any compensation given to nonemployees by a company 1 The IRS has separated the reporting of payments to nonemployees from Form 1099MISC and redesigned it for tax year Internal Revenue Service

What Is Form 1099 Nec Nonemployee Compensation

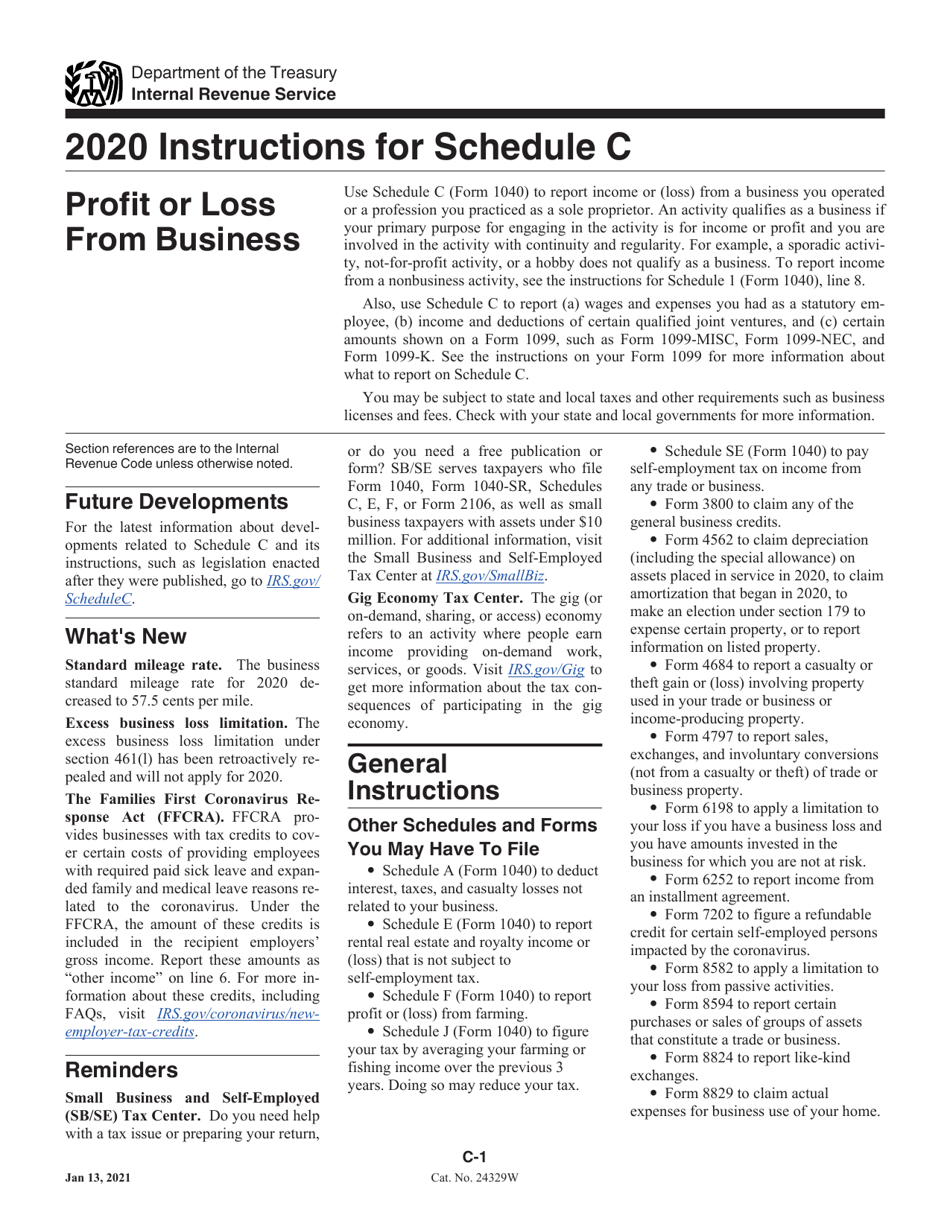

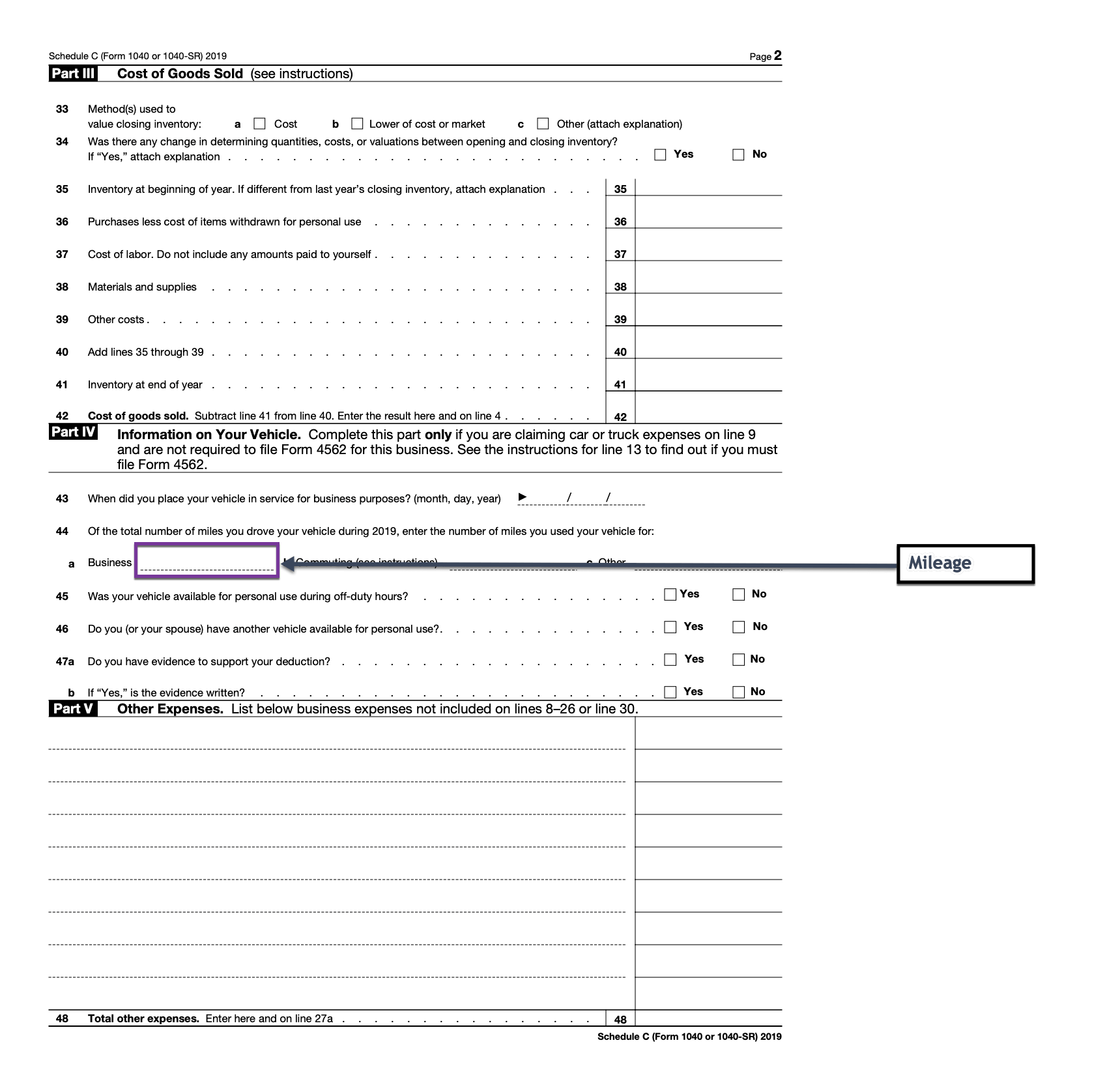

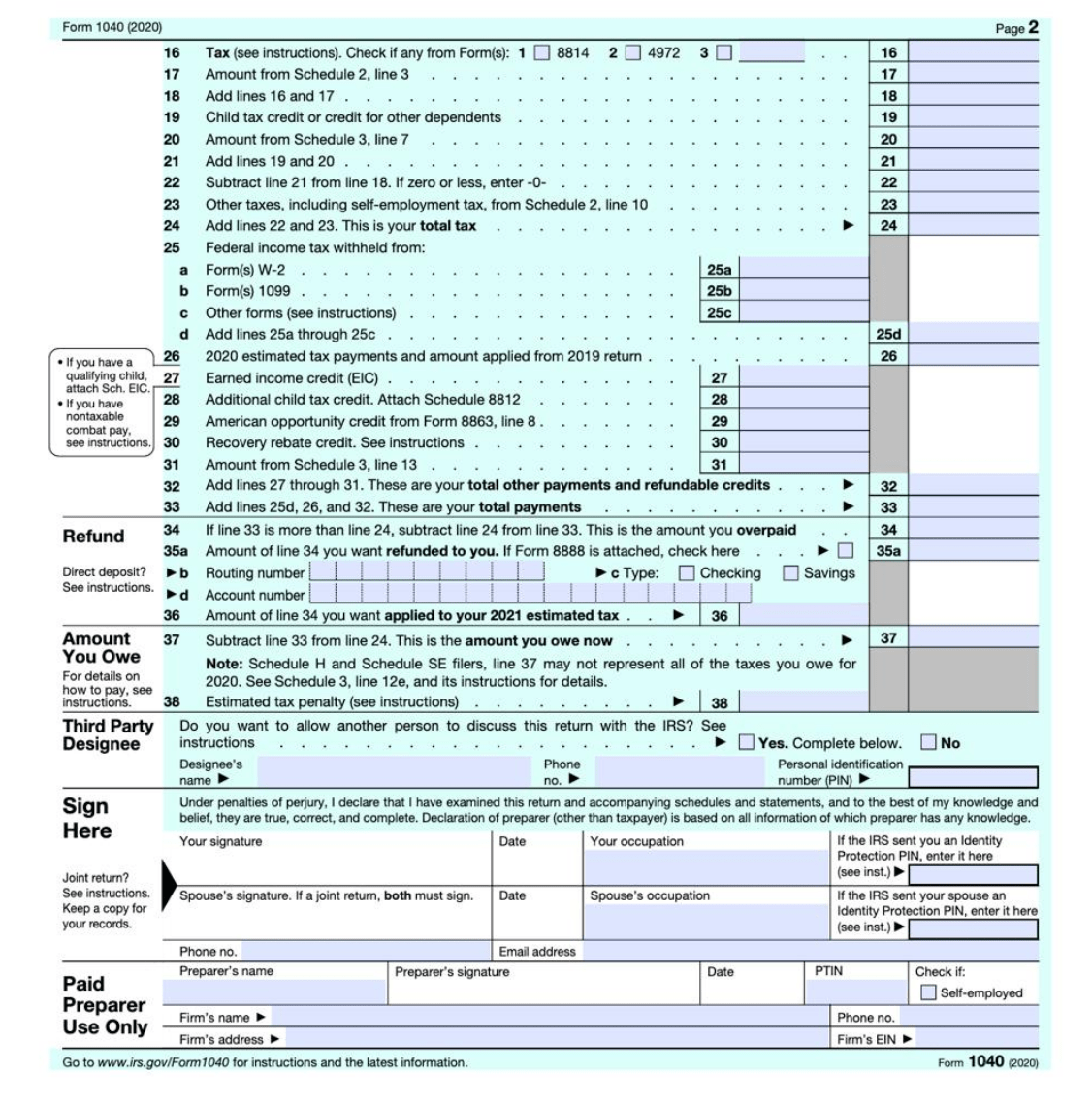

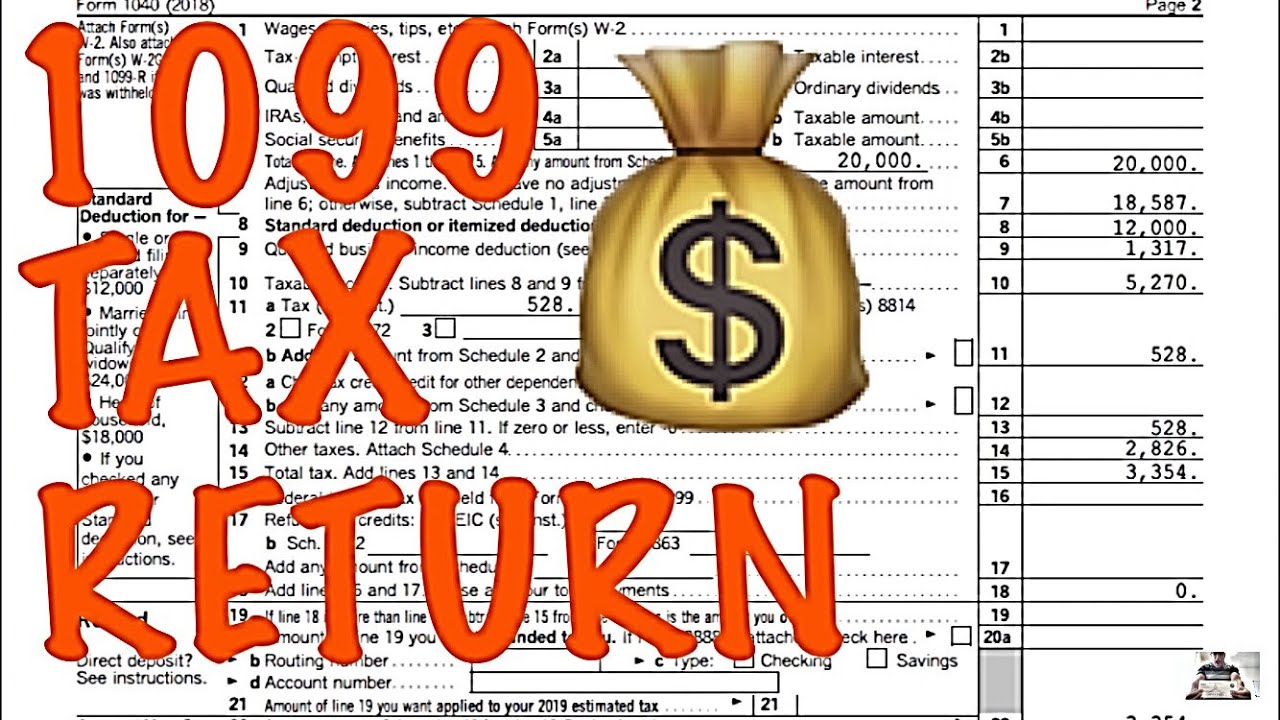

If you are selfemployed, an independent contractor, or received any income as a 1099 nonemployee in a given tax year, you'll most likely need to file Schedule C Profit or Loss From Business The Schedule C is set up similar to the Form 1040;A Schedule C form is a detailed form as figures for income, expenses and cost of goods sold all need to be recorded A net profit or loss figure will then be calculated, and then used on the proprietor's personal income tax return (on form 1040) Typically, a sole proprietor files his personal and business income taxes together, on one returnHow do I report Form 1099MISC or Form 1099NEC on my tax return?

If you receive a 1099NEC with income in Box 1 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C Why did I get a 1099NEC instead of a W2?Form 1099NEC due date is January 31stBelow that was a copy of my 1099NEC that I'd filled out, with most fields grayed out except for the Schedule C field in Box 1 I have absolutely no idea what should go in that Schedule C field If anyone has had this problem, or can tell me how to get past this, please let me know

No form received for federal;Also, use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099MISC, Form 1099NEC, and Form 1099KYou dont need the 1099 to report Sch C income, just enter all business income on Line 1 of the Sch C (since most self employed people have income in addition to the 1099 anyhow), as long as all income gets reported, that's all thats needed

Solved Can I Enter 1099 Nec With Premier Version

Best Tax Software 21 Self Employed And Smb Options Zdnet

The IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7) To use the "reinstated" 1099NECIf you received a Form 1099NEC with nonemployee compensation but you should've received the income on a W2, you don't need a Schedule C for your 1099NEC We'll ask you questions to determine the amount of the Medicare and Social Security taxes that1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC income

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

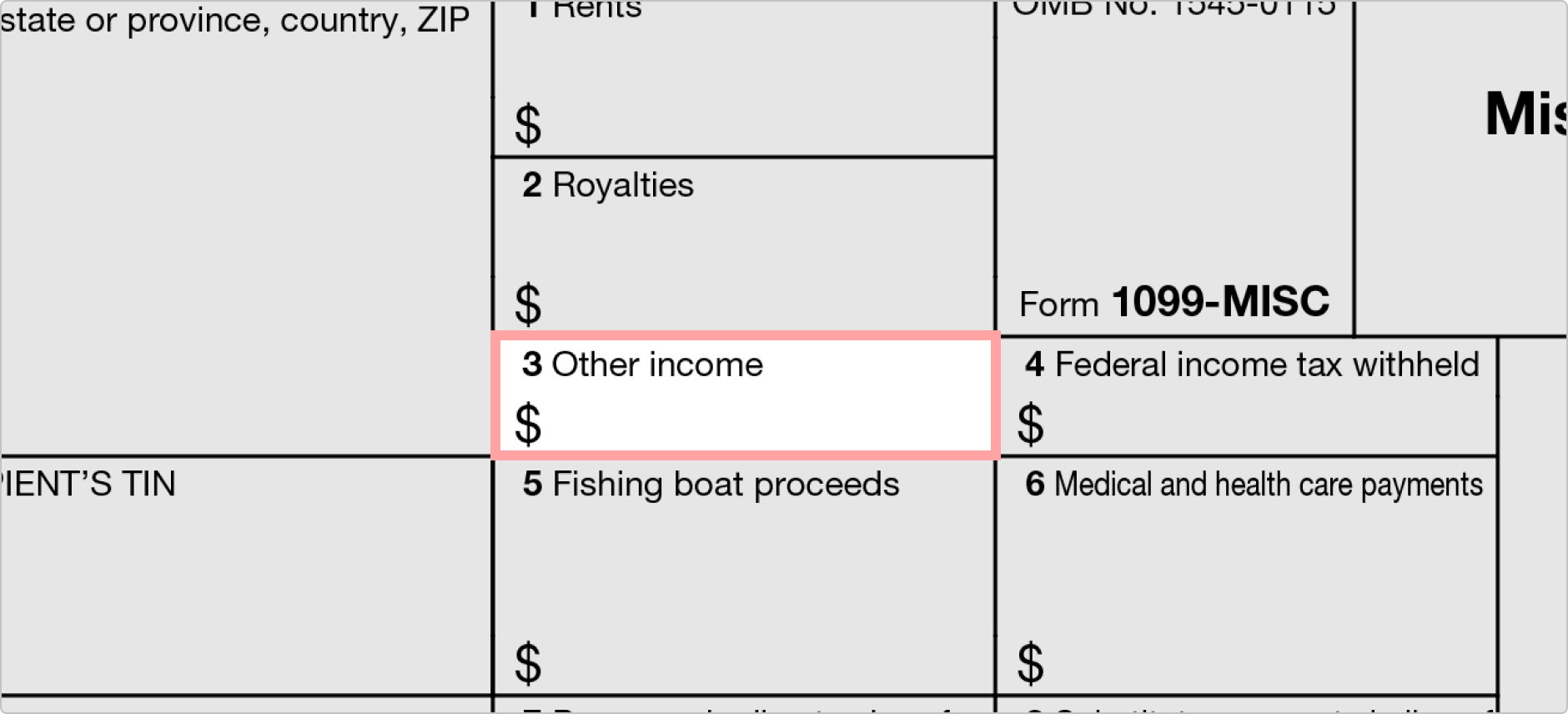

Reporting 1099 Misc Box 3 Payments

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Answer Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship) Also file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment incomeFederal Section Income Select My Forms Profit or Loss from a Business, report on a Schedule C *Effective Tax Year the 1099MISC is no longer used to report nonemployee compensation Box 7 For tax year , i s a check box, If checked, $5000 or more of direct sales of consumer products was paid to you a buyer (recipient) for resaleForm 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 to

What Is An Irs Schedule C Form And What You Need To Know About It

Startchurch Blog Updates You Must Know 1099 Misc 1099 Nec

Information about Form 1099NEC, Nonemployee Compensation, including recent updates, related forms, and instructions on how to file Use Form 1099NEC to report nonemployee compensation Current Revision Form 1099NECAny income reported on Form 1099NEC is not reportable directly on your tax return Since this type of income is considered selfemployment (nonemployee compensation) it must be linked to a Schedule C, even if there are no expenses being claimed To add a Schedule C so your 1099NEC can be linked Open or continue your return in TurboTaxSellerfinanced loan interest income Royalty income (Schedule E) Unreported tip income (Form 4137) Uncollected Social Security and Medicare Tax on Wages (Form 19) Sale of home (Form 1099S) Installment Sale (Form 6252) Cancellation of debt income (Form 1099C or Form 1099

Download Instructions For Irs Form 1040 Schedule C Profit Or Loss From Business Pdf Templateroller

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Form 1099NEC and 1099MISC Tax Help Nonemployee Compensation (Form 1099NEC) I have a 1099NEC with nonemployee compensation, but I don't have a business Why do I need a Schedule C?It includes your income, your deductions, and details about yourself and your businessWhat if my Box 1 amount is not nonemployee compensation?

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

What if my income is not selfemployment income?Yes—your Form 1099NEC will provide info that you'll need to add to your Schedule C, which is where you report income and expense details for your business You'll also file Schedule SE, SelfEmployment Tax, to pay your Social Security and Medicare taxesMORE Check out our tax guide for freelancers and

What Is The Difference Between Form 1099 Misc Vs Nec Taxbandits Youtube

Filing Forms 1099 Misc And 1099 Nec Youtube

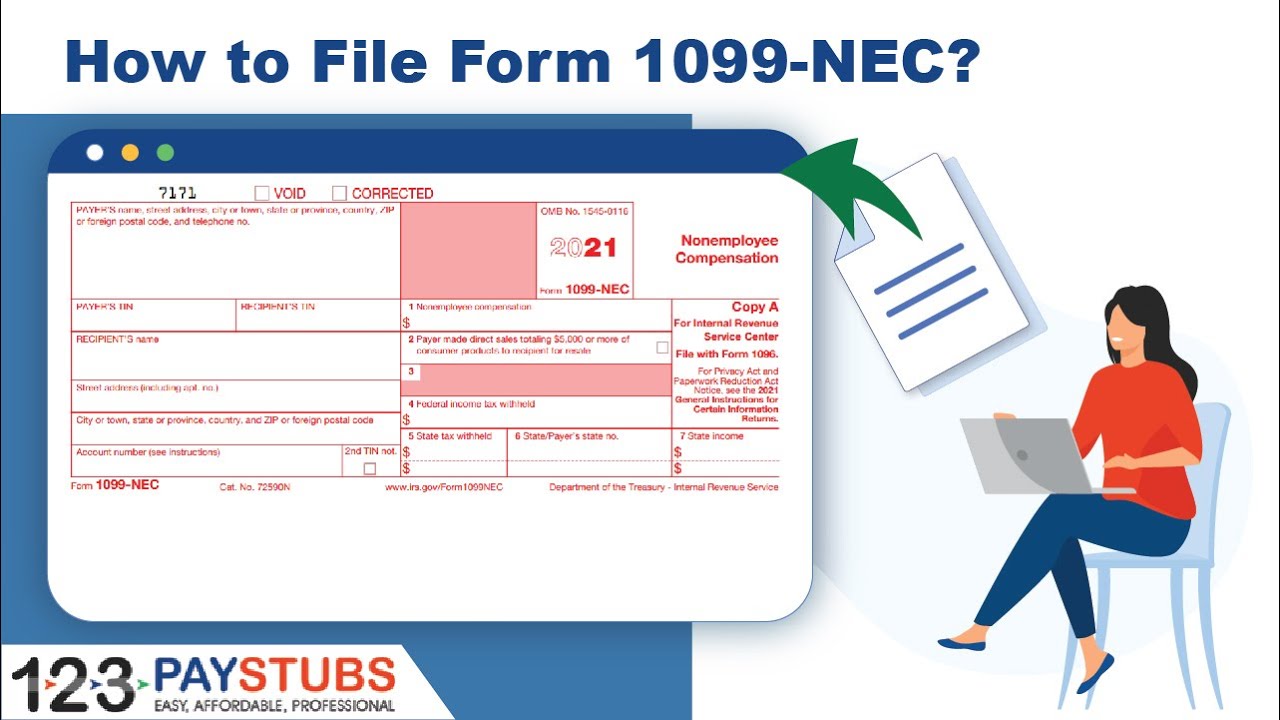

Enter a Schedule C with the profession, business code and name of the business Enter the 99M/99N screens for 1099Misc reporting or 1099NEC for nonemployee compensation;Form 1099NEC 21 Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 21 General Instructions for Certain Information Returns 7171 VOID CORRECTEDIndependent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or losses

Apps Irs Gov App Vita Content Globalmedia 4491 Business Income Pdf

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC incomeHello, Isn't 1099S a different form from 1099NEC?Since Form 1099NEC can be used to report income from a variety of sources, on screen 99N in the For drop list you must indicate whether you want the income to flow to Schedule 1, line 8, Other income Schedule C, Profit or Loss from Business Schedule F, Profit or Loss from Farming Form 19, Uncollected Social Security and Medicare Tax

1099 Misc Form Fillable Printable Download Free Instructions

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Mark them for the Schedule C and be sure to enter a multiform code that corresponds with the Schedule CFeature available within Schedule C tax form for TurboTax filers with 1099NEC income YearRound Tax Estimator Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting by end of FebruaryIt is not the responsibility of the payee to file this form, but of the payer However, the service provider needs to have a copy, in order to file that income on their own tax records, under Schedule C What is the deadline for 1099NEC?

New Irs Form 1099 Nec Pronto Tax School

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

Form 1099NEC is used to report payments made to nonemployees or independent contractors for their work Previously, it was reported in box no 7 of Form 109Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 To access the Form 1099NEC Worksheet Press F6 on the keyboard to open the Forms List Type 99N on your keyboard to highlight the 1099NEC Wks Select OKForm 1099NEC is an information return that is used to report nonemployee compensation to the IRS The non employee compensation includes payments made to freelancers, independent contractors, and other selfemployed individuals Until the tax year 19, this information was reported on Form 1099MISC Box 7

Yearli W 2 1099 1095 Online Filing Program

What Is A 1099 Form H R Block

A Schedule C is not the same as a 1099 form, though you may need IRS Form 1099 (a 1099NEC in particular) in order to fill out a Schedule C »How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business When you complete Schedule C, you report all business income and expensesIf you have multiple Schedule C forms and multiple 1099M/1099NEC forms, make sure you enter the correct MFC (Multiform Code) In the example below, the florist would be MFC 1, landscaping MFC 2, and woodworking MFC 3 Delete the additional Schedules C that were generated incorrectly by the 99M/99N screen (s)

Re When Entering 1099 Nec Or 1099 Misc The Progra

1099 Misc Income Doesn T Appear On Schedule C

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21You can Create a new Schedule C or add the income to an existing Schedule C (same type of work) The income from the 1099Misc Box 7 or 1099NEC will be automatically pulled to the Schedule C If you have already added the 1099MISC/1099NEC in the program you will need to take different steps to associate the Schedule C to the 1099MISC/1099NECI am trying to finalize my return and the program is requiring me to enter something for box c on my 1099 NEC but I do not have this box on my form, please advise read more Barbara Enrolled Agent, Paralegal 21,010 satisfied customers I

1099 Misc Form What Is It And Do You Need To File It

What To Do When You Wrongly Receive A 1099 Nec Eric Nisall

To avoid an underpayment penalty, be sure to include your miscellaneous income on your Form 1040 If your income is nonemployee compensation, you'll likely need to complete Schedule C , Profit or Loss From Business, and then transfer the net earnings to Form 1040Section 6071 (c) requires you to file Form 1099NEC on or before January 31, 22, using either paper or electronic filing procedures File Form 1099MISC by February 28, 22, if you file on paper, or , if you file electronicallyForm 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous income

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

What Does Implementing Form 1099 Nec Mean For Your Business Lwbj Cpas And Accountants Taxes Audits M A West Des Moines And Ames Iowa

But the 1099MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney Although the 1099MISC is still in use, contractor payments made in and beyond will be reported on the new form 1099NEC The due date for the 1099NEC is January 31 in the year following the applicable tax yearI recently received 1099NEC form from my employee and while filing taxes, turbotax asks me to (REVIEW and ADD the amount in Schedule C if needed) I just do NOT know what amount should be in thereHow to enter Form 1099NEC on a tax return (Schedule C) Generally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

New Form 1099 Deadline

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Fillable 1099 Nec Form Fill Online Printable Fillable Blank Pdffiller

1

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

What You Need To Know About Instacart 1099 Taxes

List Of The Most Common Federal Irs Tax Forms

Irs Releases Form 1040 For Tax Year Taxgirl

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Www Irs Gov Pub Irs Pdf F1099msc Pdf

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Publication 559 Survivors Executors And Administrators Internal Revenue Service

1099 Misc Form Fillable Printable Download Free Instructions

How To Fill Out And Print 1099 Nec Forms

Re 1099 Misc Income Doesn T Appear On Schedule C

Major Changes To File Form 1099 Misc Box 7 In

Tax Question For Wag Walkers Wagwalker

Do You Have To File A 1099 Under 600

How To Enter Form 1099 Nec On A Tax Return Schedule C Crosslink Tax Tech Solutions

Www Efile Com Tax Service Pdf 0015 Pdf

Www Irs Gov Pub Irs Prior I1099mec 21 Pdf

1099 Misc Form Fillable Printable Download Free Instructions

How To File Schedule C Form 1040 Bench Accounting

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec Filing Due On Feb 1 21 Advisori Finance Cpas For Startups

Workplaceservices Fidelity Com Bin Public 070 Nb Sps Pages Documents Dcl Shared Stockplanservices Sps Taxes Whats New Pdf

How To Apply For A Ppp Loan If You Re Self Employed Nav

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Ultimate Tax Guide For Uber Lyft Drivers Updated For 21

Irs Releases Form 1040 For Tax Year Taxgirl

Freetaxusa 21 Tax Year Review Pcmag

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Www Akronohio Gov Cms Resource Library Files irinst Item 12b Form Ir Instructions Pdf

1099 Nec Filing Due On Feb 1 21 Advisori Finance Cpas For Startups

:max_bytes(150000):strip_icc()/Form10994.02.42PM-e20cc398bd144533a948802c6da25ea5.jpg)

What Is Form 1099 Div

All About Forms 1099 Nec And 1099 K Brightwater Accounting

Communications Fidelity Com Sps Library Docs Bro Tax Sar Click Pdf

1099 Misc Box 7 Schedule C

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income Pg1 4012 Pdf

What Are Information Returns Irs 1099 Tax Form Types Variants

Form 1099 Nec Requirements Deadlines And Penalties Efile360

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

What Is Form 1099 Nec For Nonemployee Compensation

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Www Irs Gov Pub Irs Pdf I1099msc Pdf

What Is Form 1099 Nec

3

Form 1099 Nec Is Making A Come Back

What Is Form 1099 Nec Nonemployee Compensation

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

How To File For Taxes As A 1099 Worker Form Pros

Solved How And Where To Post Claim Irs Notice 14 7 Excludable Income

E File Your 1099 Misc Form Online In 5 Easy Steps Online Efile Irs Extension

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Schedule C 1099 Misc Youtube

Financial Information Needed To File A Tax Return For Your Vacation Property Schedule C Vacationlord

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

Filing Taxes With Multiple Sources Of Income Credit Karma

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Form 1099 Nec Is Making A Come Back

1099 Misc Box 7 Schedule C

2

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Misc Instructions

How To File Form 1099 Nec For Tax Year 123paystubs Youtube

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

3 21 3 Individual Income Tax Returns Internal Revenue Service

3

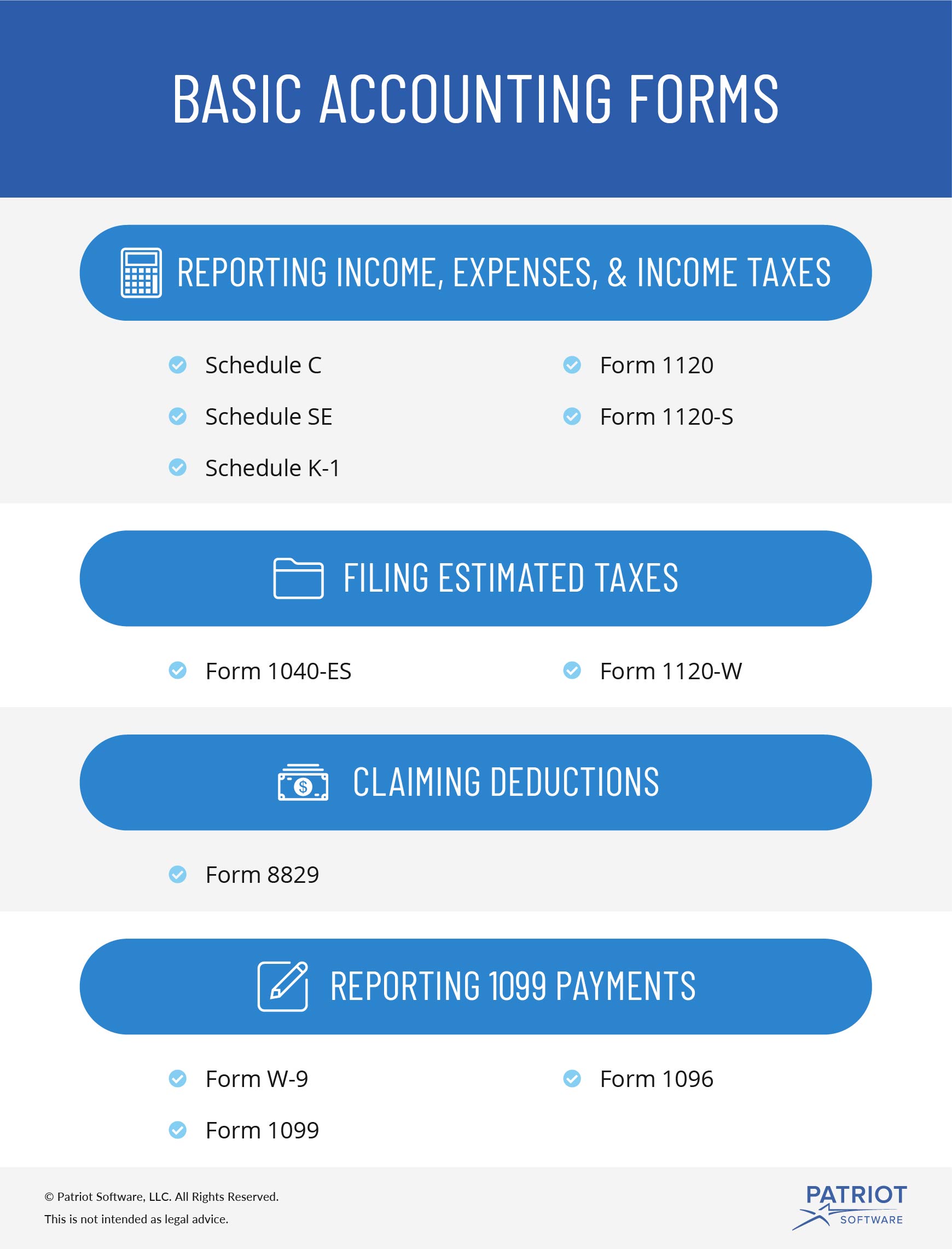

Basic Accounting Forms Irs Forms For Your Small Business

1099 Misc 1099 Nec Employer S Guide To 1099 S Finvisor

3

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

0 件のコメント:

コメントを投稿